This Insurance Scheme Is No “Match” For The Law

You expect your roof shingles to match when the damaged ones are replaced. Tennessee law even requires it. Yet some insurance companies are working to destroy the “matching law.”

Brent Simmons was fuming. Indignant.

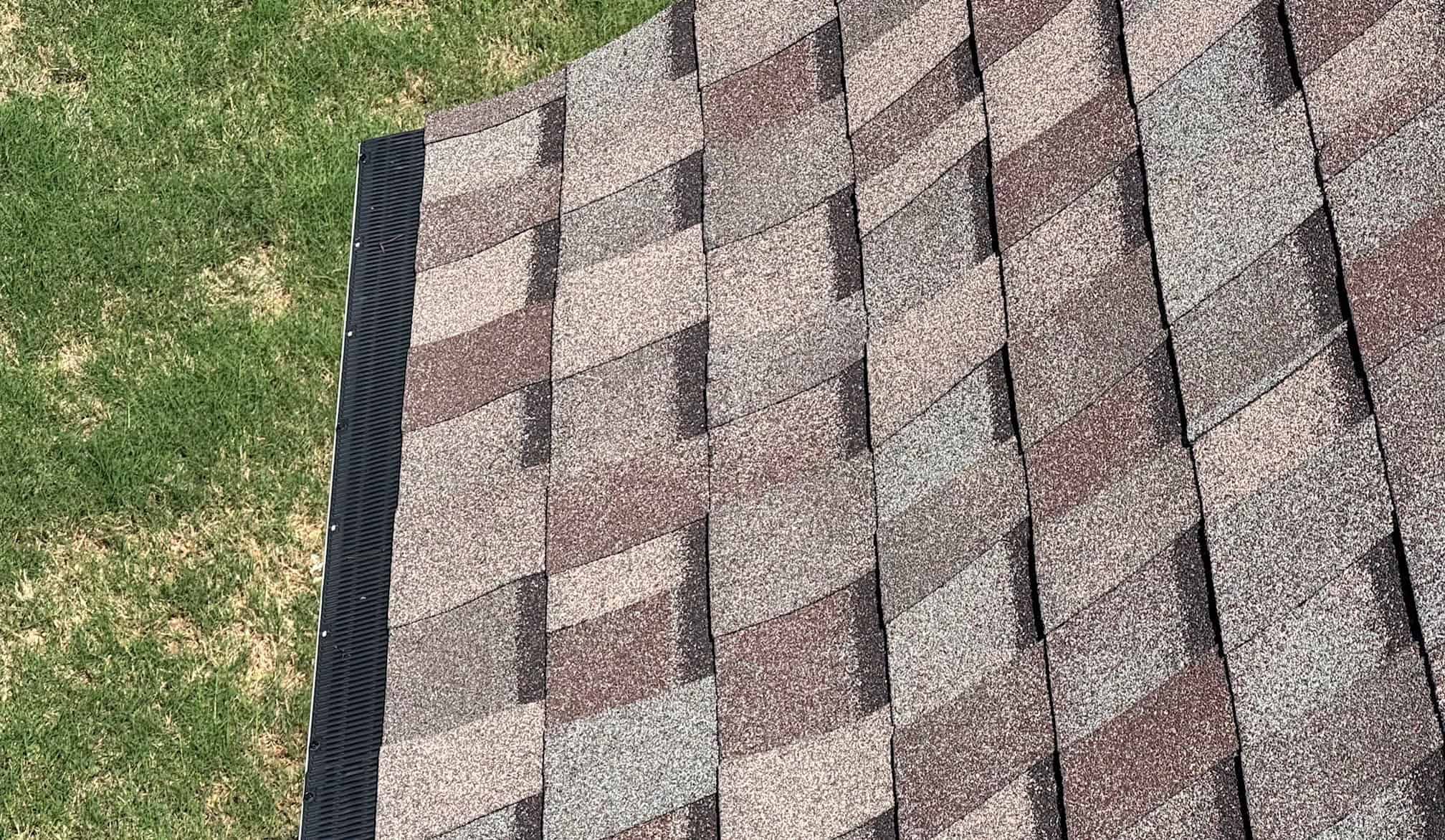

The owner of your #WiseChoice roofing company, Restoration Roofing, was as hot as the summertime shingles on that Collierville, TN roof high above us as we talked in his customer’s front yard.

“When the insurance company’s inspector came out to look at this roof, I had one of my project managers out here, the person who originally found damage up here,” said Simmons. “They both agreed that there were over 16 wind-damaged shingles. When we get the report back from the actual insurance adjuster, there are only six damaged shingles.”

Simmons said the adjuster also offered no guarantee that any replacement shingles covered under the insurer’s replacement costs would match his customer’s undamaged shingles, even though Tennessee is one of 16 “matching states” that requires, by regulation, that replacement parts must match existing ones.

“We have more adjusters coming back saying that they do not acknowledge that,” Simmons said.

They have to acknowledge that. It’s the law.

Whether it’s roof shingles, siding, flooring or other property damage caused by something covered under your insurance policy, the rule of Tennessee law is codified in Tenn. Comp. R. and Regs. 0780-01-05-.10:

“…when a loss requires replacement of items and the replaced items do not match in quality, color or size, the insurer shall replace items so as to conform to a reasonably uniform appearance according to the applicable policy provisions. This applies to interior and exterior losses. The insured shall not bear any cost above the applicable deductible, if any.“

Yet some insurance companies still try to deny the rule, even ignore it. Don’t bother trying to get an insurance adjuster to talk about it. Instead, you have to find a lawyer who knows where the insurance companies are coming from — and who dared to go on the record about the insurance industry’s perspective on matching regulations.

The industry’s side: matching regulations raise replacement costs.

“It is a matter of great importance to insurance companies because ‘matching’ problems with a slightly damaged section of roof or flooring can lead to a domino effect of tear out and replacement costs of many items which are not damaged,” wrote the Hartford, Wisconsin-based law firm Matthiesen, Wickert & Lehrer, S.C. in this matching regulations guide on its website. “The problem of partial replacement is especially troubling where the damaged siding or shingles have been discontinued, making it virtually impossible to properly match.”

As for the insurance industry’s argument that it’s impossible to match a policyholder’s shingles when those shingles have been discontinued, Tennessee attorney J. Brandon McWherter said in those instances, the insurer must replace the entire roof. “In those circumstances, is the insurance company obligated to replace the entire roof? Common sense and an understanding of the purpose of insurance and indemnity tells me ‘Yes,'” McWherter wrote in this blog. He cited two Tennessee legal cases that he said are now case precedents that support putting the insured’s entire property back to its pre-loss condition.

Kevin Snider, founding attorney of your #WiseChoice law firm, Snider & Horner, PLLC in Germantown, TN, has sued insurance companies over the matching issue. He discovered something they’re doing with some Tennessee homeowners’ policy renewals. He said some insurers are sneaking new language into those renewals — language that denies Tennessee policyholders their rights to matching replacement parts, in spite of the state’s regulation.

“Our position is that is illegal,” Snider said. “You can’t circumvent in a private contract what’s in a state regulation. Why are you changing the policy on a renewal term and not disclosing it to policyholders? Shouldn’t that reduce their premiums at the very least? Because they’re getting less coverage.”

Snider recommended a course of action for consumers whose insurers put up a fight over matching replacement parts. “I would recommend writing a formal demand letter, specifically stating that the insurance company comply with the (Tennessee) matching requirement and also putting them on written notice that if they do not, you will pursue a claim not only for breach of contract, but also for bad faith denial of the claim, in which you’ll seek additional remedies under Tennessee Code Annotated (TCA) Section 56-7-105.” Snider emphasized consumers should include the mention of that code section in their demand letters.

Simmons added that roofers have an obligation to be advocates for their customers. He said that includes confronting their clients’ insurance adjusters when the facts call for it.

“Our job is to point out facts,” Simmons said. “That can include documentation that the shingle is discontinued and demonstrating that any potential ‘close match’ does or does not match. Insurers always try to get us to use a different shingle to see if it will pass as a similar look. We often times have to install said shingle just to prove that it does or does not match.”

Simmons eventually won his argument with his Collierville customer’s insurer. It agreed to replace all of the damaged shingles.

With matching shingles.

Because it’s the law in the “matching state” of Tennessee.

Copyright 2025 Wise ChoicesTM. All rights reserved.

andy wise choices, andy wise memphis, consumer protection, matching law, memphis roofers, roofers, Roofing, wise choice, wise choices